PNNL, Frances White, October 25, 2011

RICHLAND, Wash. - Identifying atypical information in financial data early could help identify problematic financial trends such as the systemic risk that recently put the U.S. and global financial systems in a downward fall. Recognizing such anomalous information can also help regulators, investors and advisors better manage their investment and savings portfolios.

Now, new analytical software developed by Battelle researchers based in Richland at the Department of Energy's Pacific Northwest National Laboratory can do just that. The technology has been licensed by Battelle to financial services company V-INDICATOR ANALYTICS, LLC, of Spokane, Wash.

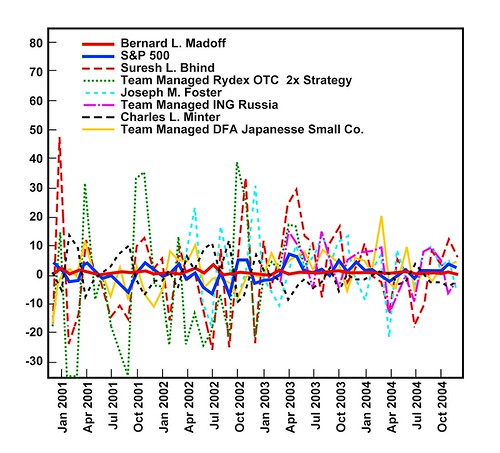

In a demonstration of this technology, the Battelle-developed Anomalator™ software recently picked out the atypically stable and positive returns reported by disgraced financier Bernard Madoff as an anomaly among hundreds of funds. He is now serving a 150-year prison sentence for scamming investors out of as much as $65 billion in a Ponzi scheme that spanned at least 20 years. Unfortunately, Madoff's fraud was concealed for more than 15 years. The use of this sophisticated anomaly-detection and visualization tool could have exposed Madoff early on, and can help expose future scandals, its inventors say.

Analysis of fund data done with the Anomalator software illustrates how disgraced financier Bernard Madoff's returns (solid red line) were an anomaly, as they were atypically stable while other funds repeatedly spiked up and down. Anomalator's inventors say their sophisticated anomaly-detection and visualization tool could have exposed Madoff and can help expose future scandals.

Read more.