Big Data Landscape, v 3.0, analyzed

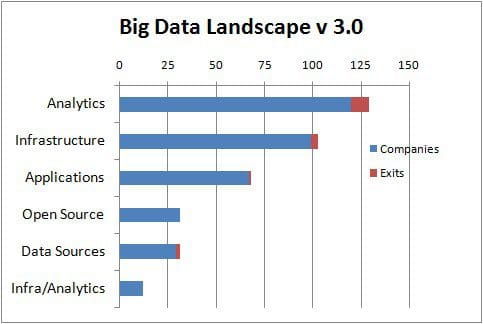

We analyze the Big Data Landscape and identify the most popular market segments in Analytics, Infrastructure, Applications, Open Source, and Data Sources categories. It is still early - only 4.5% of companies had exits.

By Gregory Piatetsky, May 15, 2014.

A recent post by Matt Turck, a partner at FirstMark Capital, has a great picture of Big Data Landscape v. 3.0.

Matt Turck writes that the space is getting crowded

The landscape above is a treasure trove of information, but very hard to make sense of. To analyze it quantitatively, we broke it down by categories and subcategories (thanks to Grant Marshall for getting the numbers).

First obvious inference is that the market is indeed in early stages - of the 358 companies in the chart, only 16 had "exits" (purchased or had an IPO), about 4.5% overall. The percent of exits is highest for Analytics (7.5%) and Data Sources (6.9%) categories, and lowest for Applications (1.4%), and Open Source (zero) categories.

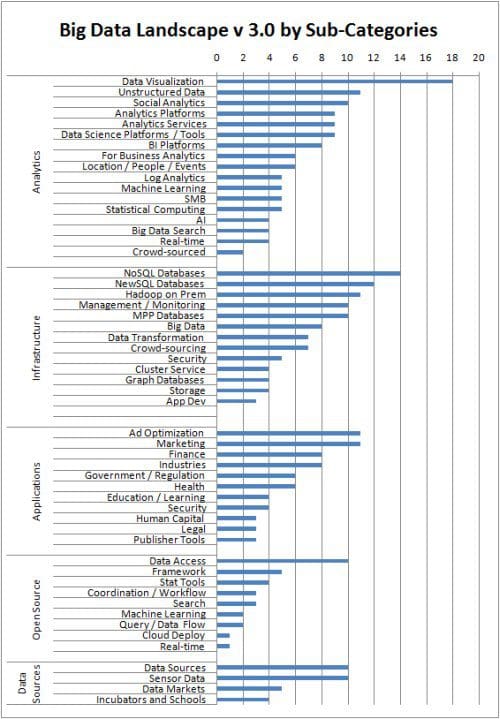

Below is the chart of the Big Data Landscape, by categories and subcategories, ordered by number of companies.

We can also see the most popular segments:

In Analytics: Data Visualization, Unstructured Data

In Infrastructure: NoSQL and NewSQL databases

In Applications: Ad optimization and Marketing.

Segments with the most exits are Social Analytics and Analytics Platforms.

Analytics - 120 companies, 9 exits (7.5%)

Infrastructure - 99 companies, 4 exits (4.0%) :

Applications - 67 companies, 1 exit (1.5%)

Open Source, 31 companies, no exits

Data Sources: 29 companies, 2 exits

Cross Infrastructure / Analytics: 12 companies, no exits

A recent post by Matt Turck, a partner at FirstMark Capital, has a great picture of Big Data Landscape v. 3.0.

Matt Turck writes that the space is getting crowded

"Entrepreneurs have flocked to the space, VCs have poured money into promising startups, and as a result, the market is starting to get crowded. Certain categories like databases (whether NoSQL or NewSQL) or social media analytics feel ripe for consolidation or some sort of shakeout (which may have already started in social analytics with Twitter’s acquisitions of BlueFin and GNIP)."

However, it is still early in the game, he says:

"we’re still in the early innings of this market. Over the last couple of years, some promising companies failed (for example: Drawn to Scale), a number saw early exits (for example: Precog, Prior Knowledge, Lucky Sort, Rapleaf, Nodeable, Karmasphere), and a handful saw more meaningful outcomes (for example: Infochimps, Causata, Streambase, ParAccel, Aspera, GNIP, BlueFin labs, BlueKai).

The landscape above is a treasure trove of information, but very hard to make sense of. To analyze it quantitatively, we broke it down by categories and subcategories (thanks to Grant Marshall for getting the numbers).

First obvious inference is that the market is indeed in early stages - of the 358 companies in the chart, only 16 had "exits" (purchased or had an IPO), about 4.5% overall. The percent of exits is highest for Analytics (7.5%) and Data Sources (6.9%) categories, and lowest for Applications (1.4%), and Open Source (zero) categories.

Below is the chart of the Big Data Landscape, by categories and subcategories, ordered by number of companies.

We can also see the most popular segments:

In Analytics: Data Visualization, Unstructured Data

In Infrastructure: NoSQL and NewSQL databases

In Applications: Ad optimization and Marketing.

Segments with the most exits are Social Analytics and Analytics Platforms.

Analytics - 120 companies, 9 exits (7.5%)

- Data Visualization: 18 Companies

- Unstructured Data: 11 Companies

- Social Analytics: 10 Companies, 2 Exits

- Analytics Platforms: 9 Companies, 2 Exits

- Analytics Services: 9 Companies

- Data Science Platforms / Tools: 9 Companies

- BI Platforms: 8 Companies

- For Business Analytics: 6 Companies

- Location / People / Events: 6 Companies, 1 Exit

- Log Analytics: 5 Companies, 1 Exit

- Machine Learning: 5 Companies

- SMB: 5 Companies

- Statistical Computing: 5 Companies, 1 Exit

- AI: 4 Companies, 1 Exit

- Big Data Search: 4 Companies

- Real-time: 4 Companies, 1 Exit

- Crowd-sourced: 2 Companies

Infrastructure - 99 companies, 4 exits (4.0%) :

- NoSQL Databases: 14 Companies, 1 Exit

- NewSQL Databases: 12 Companies

- Hadoop on Prem: 11 Companies, 1 Exit

- Management / Monitoring: 10 Companies

- MPP Databases: 10 Companies, 1 Exit

- Big Data: 8 Companies, 1 Exit

- Data Transformation: 7 Companies

- Crowd-sourcing: 7 Companies

- Cluster Service: 4 Companies

- Graph Databases: 4 Companies

- Security: 5 Companies

- Storage: 4 Companies

- App Dev: 3 Companies

Applications - 67 companies, 1 exit (1.5%)

- Ad Optimization: 11 Companies, 1 Exit

- Marketing: 11 Companies

- Finance: 8 Companies

- Industries: 8 Companies

- Government / Regulation: 6 Companies

- Health: 6 Companies

- Education / Learning: 4 Companies

- Security: 4 Companies

- Human Capital: 3 Companies

- Legal: 3 Companies

- Publisher Tools: 3 Companies

Open Source, 31 companies, no exits

- Data Access: 10 Companies

- Framework: 5 Companies

- Stat Tools: 4 Companies

- Coordination / Workflow: 3 Companies

- Search: 3 Companies

- Machine Learning: 2 Companies

- Query / Data Flow: 2 Companies

- Cloud Deploy: 1 Company

- Real-time: 1 Company

Data Sources: 29 companies, 2 exits

- Data Sources: 10 Companies

- Sensor Data: 10 Companies, 1 Exit

- Data Markets: 5 Companies, 1 Exit

- Incubators and Schools: 4 Companies

Cross Infrastructure / Analytics: 12 companies, no exits